Story: Dr. Pham Sy An – Vietnam Academy of Social Sciences

Vietnam’s international trade balance currently stands at a surplus of USD 14.08 billion, the second-highest in the past decade, despite global geopolitical instability.

In the first seven months of 2024, the ongoing conflict between Russia and Ukraine shows no signs of resolution, while rising tensions in the Middle East threaten to escalate into broader conflict, with retaliatory actions involving Israel, Iran, Hamas, and Hezbollah. Additionally, Houthi forces’ attacks on commercial ships and oil tankers in the Red Sea have disrupted this vital global maritime route, directly affecting Vietnam’s export activities.

Despite global challenges, Vietnam’s exports in the first seven months of 2024 are estimated at USD 226.98 billion, marking a 15.7% increase compared to the same period in 2023. Import turnover is estimated at USD 212.9 billion, an 18.5% rise over the same period last year.

Bright spots

Regarding export markets, the United States continues to be Vietnam’s largest export market, estimated at USD 66.1 billion, accounting for 29% of the country’s total export turnover in the first seven months of 2024. At USD 32.4 billion, China is Vietnam’s second-largest export market, up 5.8%. The European Union ranks third with USD 29.52 billion, an increase of 16.8% compared to the same period in 2023. Following are the ASEAN market (USD 21.02 billion, up 13%) and South Korea (USD 14.5 billion, up 9.8%). The structure of Vietnam’s export markets has remained largely unchanged in terms of rankings compared to previous years.

In the export goods sector, computers, electronic products, and components hold the highest export value at USD 39.6 billion, accounting for 17% of total export turnover, with key markets including the US, China, the EU, Hong Kong (China), and South Korea. Phones and components rank second, with exports reaching USD 32.6 billion, representing 14% of total export turnover. Machinery, equipment, tools, and spare parts come in third at USD 28 billion. The textile and garment sector ranks fourth at USD 20.27 billion, while footwear is fifth, with nearly USD 12.9 billion in exports. The sectors next in line in terms of export value are wood and wood products, valued at USD 8.9 billion, transportation means and spare parts at USD 8.6 billion, cameras, camcorders, and components at USD 4.68 billion, steel of all kinds at USD 5.5 billion, and seafood products at USD 5.3 billion.

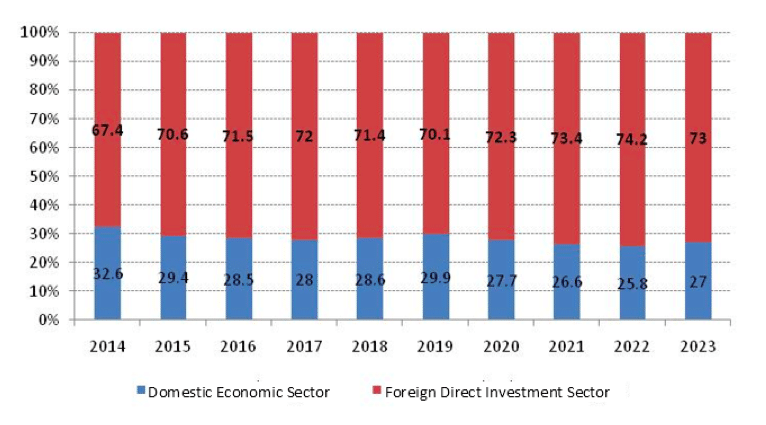

In terms of the role of economic sectors in exports, foreign-invested companies continue to dominate, as they have in previous years. Over the past decade, the foreign-invested economic sector’s export share has risen from 67.4% in 2014 to 73% in 2023. In the first seven months of 2024, the foreign-invested sector accounted for 72.2% of total exports, while the domestic economic sector contributed 27.8%.

Export turnover share by economic sector, %

Source: General Statistics Office

Old challenges

The United States and the European Union have been important export markets for Vietnam for many years. However, the U.S. Department of Commerce’s continued refusal to classify Vietnam as a market economy poses challenges for efforts to boost exports to the U.S., as it faces anti-dumping duties. Additionally, the EU’s yellow card on Vietnam’s seafood exports is constraining efforts to increase these exports to the EU market.

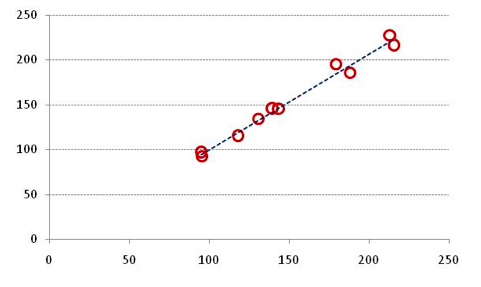

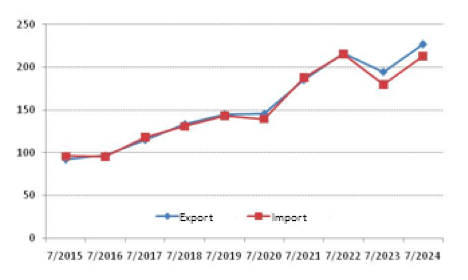

Export and import turnover have been moving in tandem, meaning an increase in exports leads to a rise in imports and vice versa. This reflects the reality that much of Vietnam’s export production is merely processing and assembly. Importing inputs, raw materials, and components from abroad for processing and assembly means that Vietnam’s added value in the supply chain is not high, and the benefits gained are correspondingly low. The parallel fluctuations in exports and imports have not been favorable for Vietnam’s economy for many years.

Chart 2. Relationship between export and import turnover in the first seven months from 2015 to 2024, Billion USD

Chart 3. Trends in export and import turnover in the first seven months from 2015 to 2024, Billion USD

Source: General Statistics Office

The more Vietnam strives to boost exports, the more the FDI sector and import partners benefit. This is due to the structure of Vietnam’s economy and the limitations in developing supporting industries. As a result, the added value that the domestic economy gains from export activities is very low.

New difficulties

Trade tensions between the U.S., Europe, and China are putting Vietnam’s trade activities in a difficult position. Vietnam’s exports are mainly focused on the U.S. and European markets, while imports are primarily from China. Therefore, Vietnam’s export activities to the U.S. and Europe are subject to more scrutiny as trade conflicts between these countries and regions continue to intensify.

Escalating and unpredictable conflicts in regions with key maritime routes are placing Vietnam’s export activities at heightened risk. Many of Vietnam’s exports to crucial markets pass through these routes, and the impact is evident in the recent significant rise in freight rates, which has created additional challenges for the country’s export sector.

The positive performance of Vietnam’s export activities in the first seven months of 2024 offers hope for a more optimistic outlook in the remaining months of the year. However, the underlying issues, risks, and emerging challenges require policymakers and the business community to exercise greater caution, strengthen ties, and work together more effectively. This coordinated effort is essential to successfully mitigate risks and achieve better outcomes in export activities, ultimately contributing to the government’s 2024 goals for economic growth and macroeconomic stability.